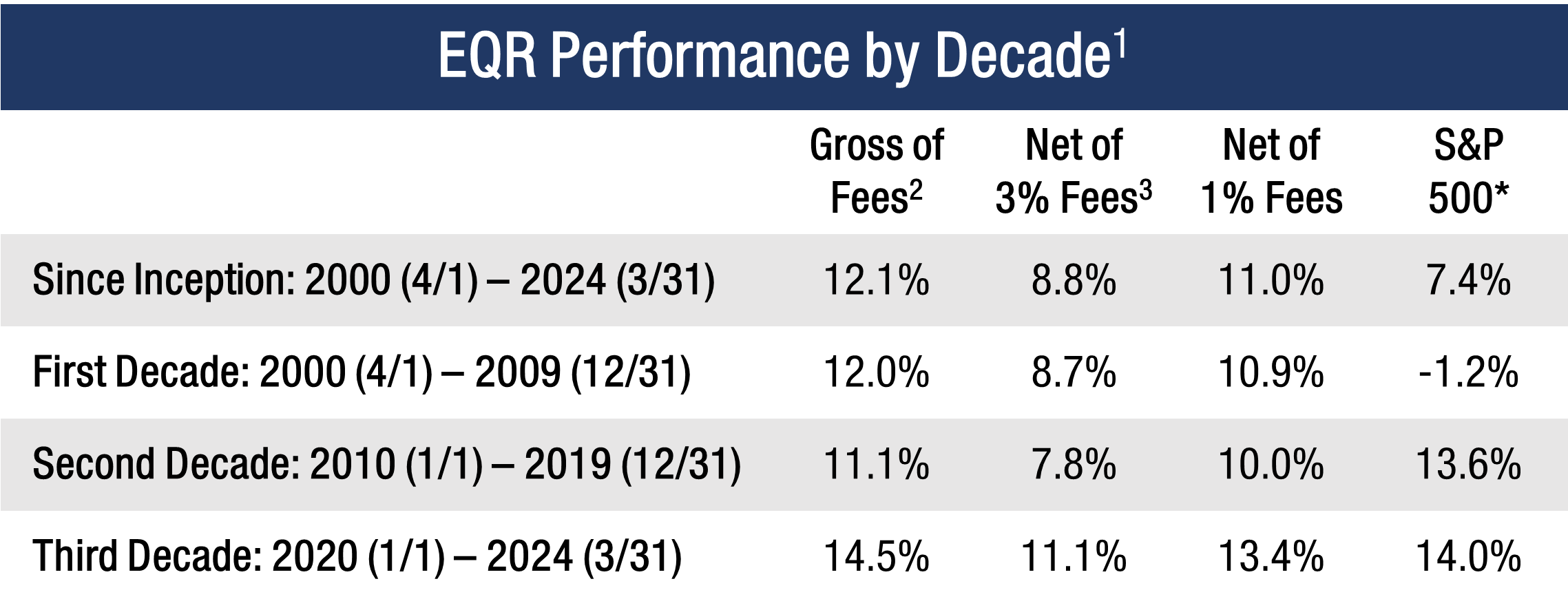

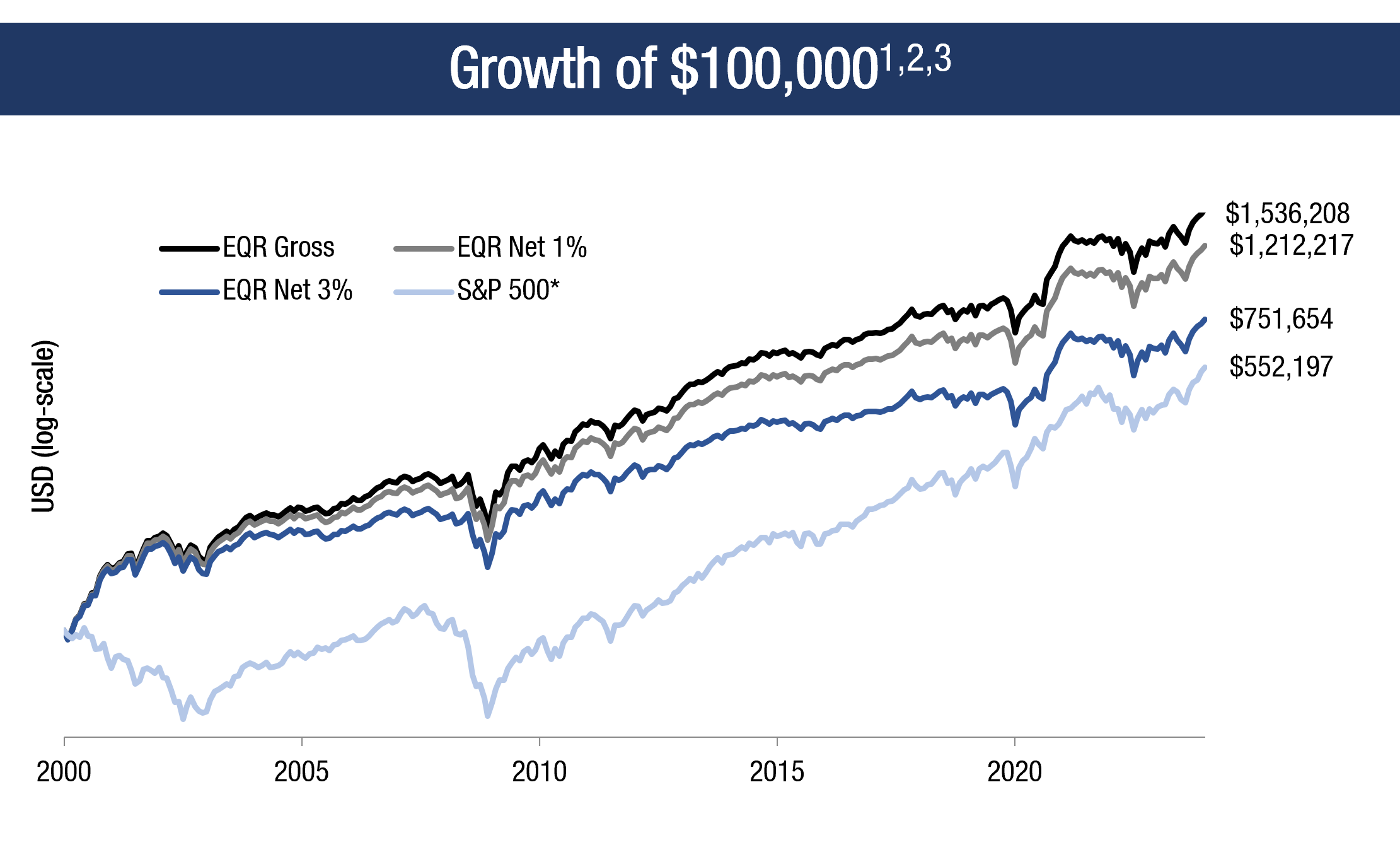

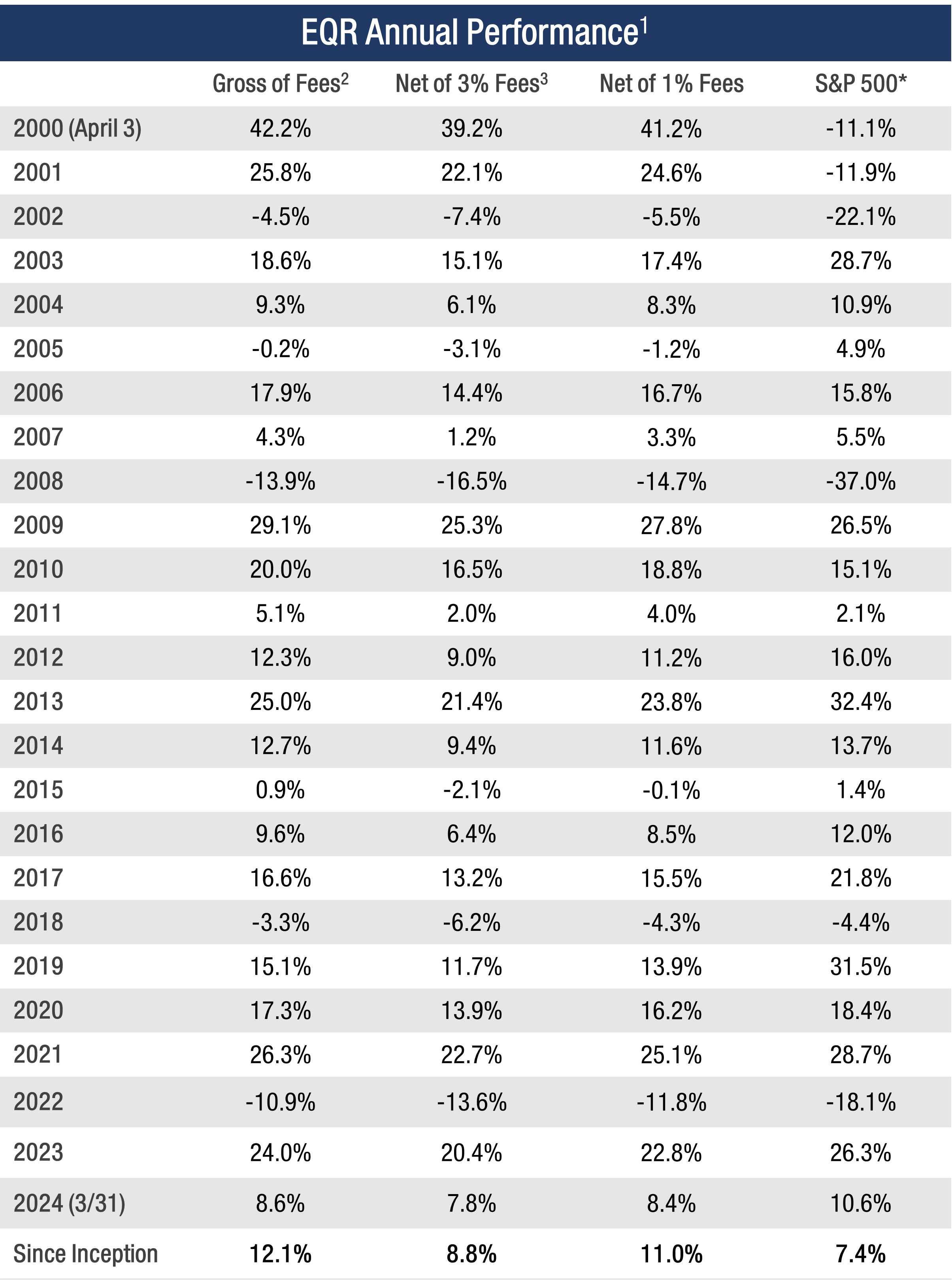

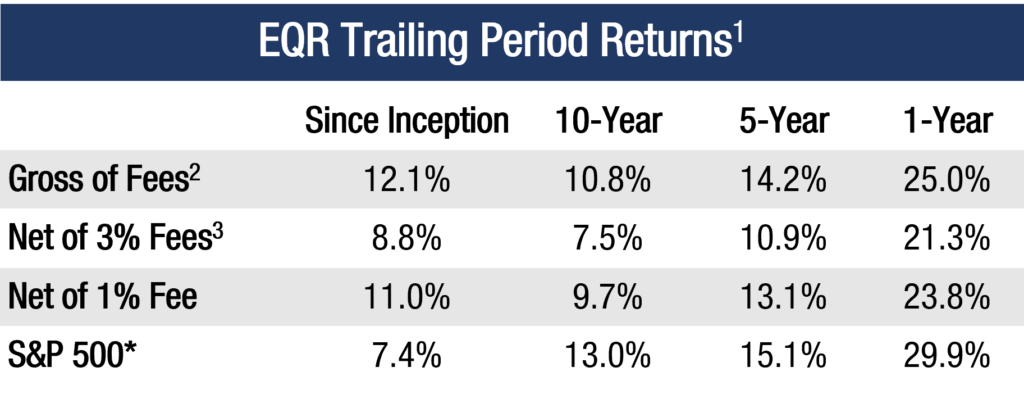

*Benchmark

As of March 31, 2024

Inception date: April 3, 2000

1Total return performance includes unrealized gains, realized gains, dividends, interest, and the reinvestment of all income.

2Pure gross returns are gross of all fees and do not reflect the deduction of transaction costs in wrap portfolios. Pure gross returns are supplemental information.

3Net returns are the EQR Total Accounts composite pure gross returns reduced by the highest wrap fee as required under GIPS; 3% is the highest tier fee under graduated fee schedules for smaller asset levels at some partner firms. Most ACR partners charge significantly less than 3%.